how much taxes does illinois take out of paycheck

Regardless of your filing status the income tax is a flat rate of 495. The wage base is.

The Illinois bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

. How do I figure out the percentage of taxes taken out of my paycheck. What taxes do Illinoisan pay. According to the Illinois Department of Revenue all incomes are created equal.

The current rate for Medicare is 145. How much do you make after taxes in Illinois. Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding.

Employers are responsible for deducting a flat income tax rate of 495 for all employees. Personal income tax in Illinois is a flat 495 for 20221. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding amount its not that easy. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. For each pay period your employer will withhold 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes.

Unemployment Taxes Illinois does not permit employers to. How much is 90k after taxes in Illinois. You can even use historical tax years to figure out your total salary.

The Illinois state income tax is a flat rate for all residents. Estates over that amount must file an Illinois. How much taxes is taken out of a paycheck in Illinois.

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. To use our Illinois Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. As of 2021 estates worth less than 4 million are exempt.

Together these are called FICA. Just enter the wages tax withholdings and other information required. Illinois Estate Tax.

If youre married filing jointly youll see the 09 percent taken out of your paycheck if you earn 250000 or more. Illinois is one of 13 states with an estate tax. The Illinois salary calculator will show you how much income tax is taken out of.

The Illinois Paycheck Calculator uses Illinois tax tables and Federal Income Tax Rates for 2022. A single Illinoisan who earns. How Much Taxes Get Taken Out Of Paycheck In.

Well do the math for youall you need to do is enter. Yes Illinois residents pay state income tax. After a few seconds you will be provided with a full breakdown.

Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Illinois tax year starts from july 01 the year before to june 30 the current year. How much is 75k after taxes in illinois.

Personal income tax in Illinois is a flat 495 for 20221.

Why Does My Federal Withholding Vary Each Paycheck

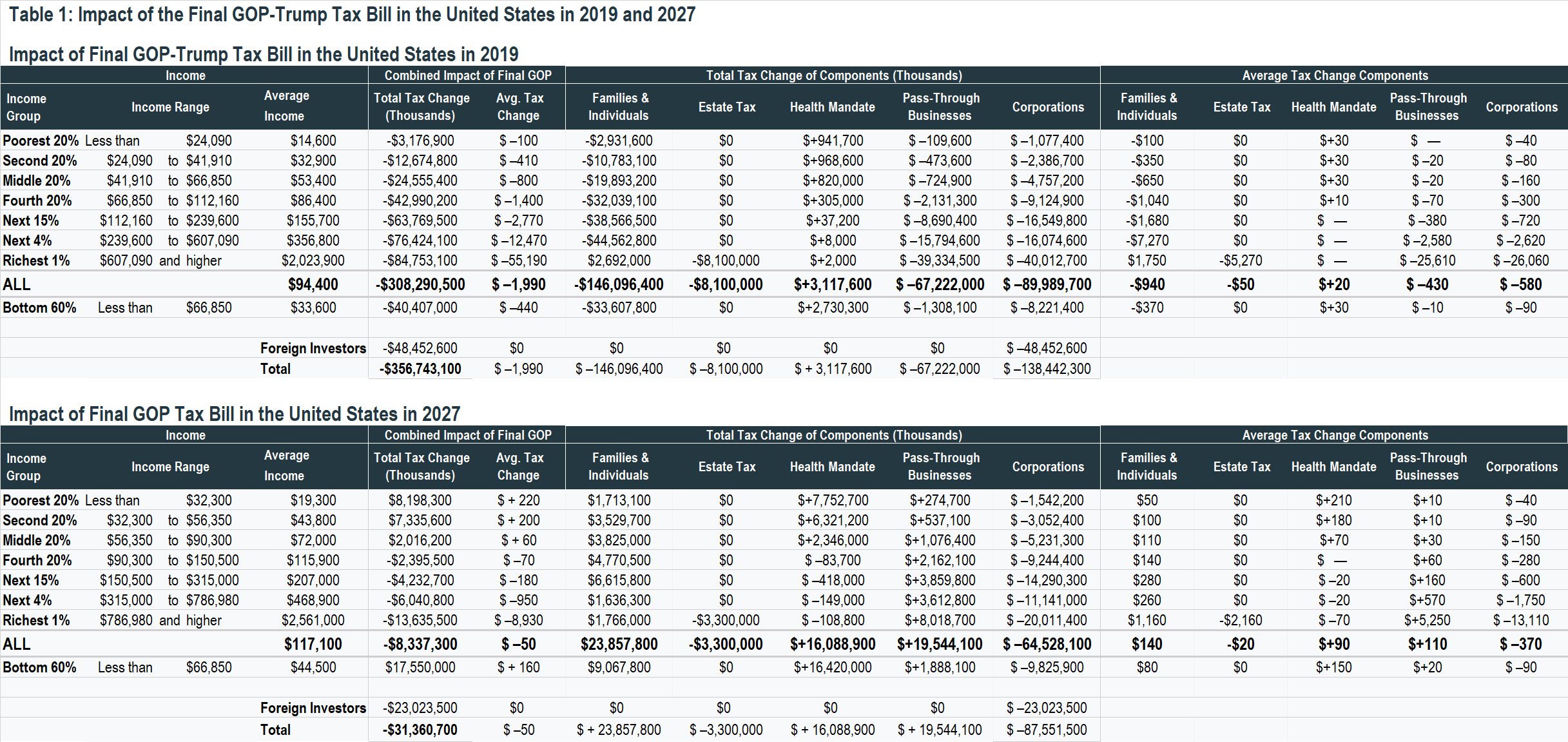

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

Pay Stub Info Learn Examples Testimonials Free Preview Best

Different Types Of Payroll Deductions Gusto

Salary Paycheck Calculator Calculate Net Income Adp

Illinois Paycheck Calculator Smartasset Com

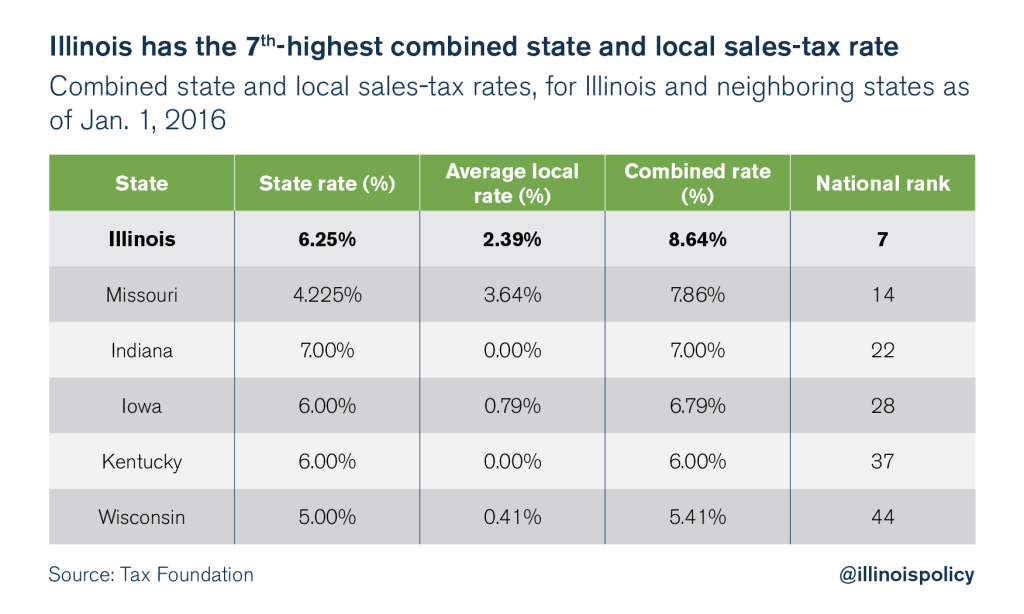

Visualizing Taxes Deducted From Your Paycheck In Every State

Pay Stub Requirements By State Overview Chart Infographic

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

![]()

Illinois Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Project Design Lead Salary Comparably

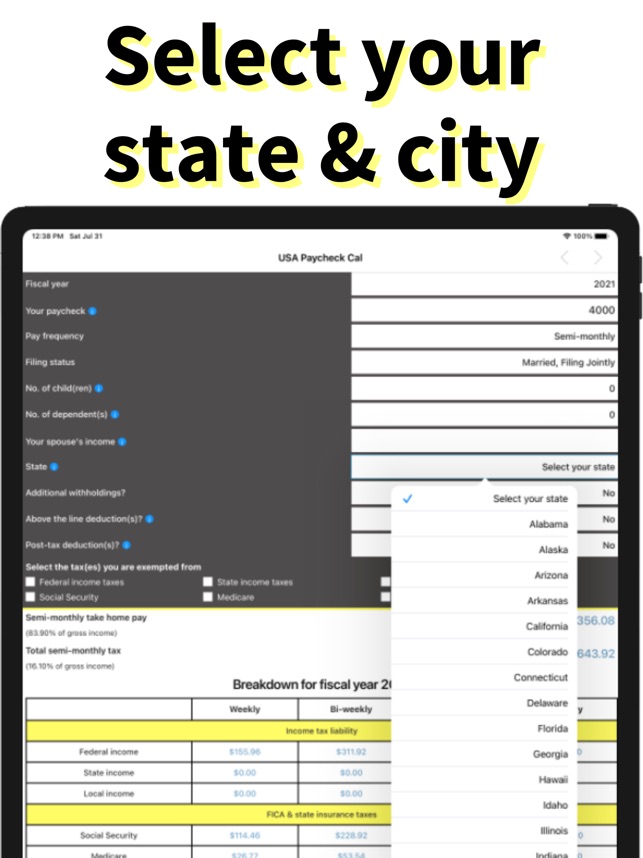

Usa Paycheck Calculator On The App Store

How To Read Your Paycheck Stub Clearpoint

Pappas Auction Of Delinquent Cook County Property Taxes Postponed Indefinitely Alderman Tom Tunney 44th Ward Chicago

Can You Opt Out Of Paying Social Security Taxes Mybanktracker

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Prepare And E File Your 2021 2022 Illinois And Irs Income Tax Return